Value investing: all you need to know

Value investing is a long-term strategy centered on purchasing and holding stocks that have the potential for future appreciation. These are often “undervalued stocks,” which may be overlooked by the market.

Some investors believe that value investing can deliver higher returns over time. Unlike short-term strategies where stocks are frequently bought and sold, value investing involves holding onto assets for an extended period. This article explains the basics of value investing and how similar long-term positions can be held through derivatives.

Understanding Value Investing

Value investing involves purchasing stocks that appear undervalued, with the expectation they will increase in value over time. This approach allows companies to grow, improve cash flow, and provide a solid balance sheet in the future, making it an integral part of fundamental analysis.

Stock prices often fluctuate due to news reports or financial statements, influencing market perception. While short-term traders focus on these movements, value investors prioritize long-term company performance, overlooking technical analysis to focus on intrinsic quality and potential growth.

Typically, value investors wait until a stock’s price falls below its intrinsic value, aiming to acquire it at a “discount.”

Returns in Value Investing

Value investors believe returns from undervalued stocks can surpass those of growth stocks or stocks trading above their intrinsic value, which are often considered overvalued.

The price-to-book (P/B) ratio is one way to assess potential returns. This ratio compares a company’s market value (total share value) with its book value (net asset value) and can indicate undervaluation. The formula is:

P/B ratio = market price per share / book value per share

Lower P/B ratios can suggest undervaluation, though they vary by industry. However, caution is needed, as low ratios may also indicate deeper issues with a company’s fundamentals, like cash flow or dividends.

Is Value Investing Still Relevant?

Value investing gained popularity in the 20th century through figures like Benjamin Graham and Warren Buffet. We’ll explore their methods later on.

Many investors wonder if value investing remains effective or if shorter-term strategies might better avoid market downturns. This debate depends on individual goals, risk tolerance, and available capital, shaping whether value investing or long-term trading is more suitable.

How to Pursue Value Investing

- Identify suitable stocks. Many value investors choose stable blue-chip stocks over volatile penny stocks or growth stocks, which may peak and then decline. Industry choice matters, too; for example, pharmaceuticals and finance often show more stability than sectors like oil and renewable energy.

- Research your chosen stocks. Investors evaluate company fundamentals impacting long-term growth, including risk factors, financial plans, dividend payments, earnings, and potential acquisitions.

- Focus on steady returns. Rather than chasing quick gains, value investors seek low-risk options offering consistent returns. Financial ratios like PEG and P/E can help spot undervalued stocks and assess risk within a sector.

- Diversify your portfolio. Figures like Warren Buffet and Benjamin Graham recommend diversification, balancing stocks with bonds. This helps mitigate risk, as even historically steady value stocks aren’t guaranteed.

Notable Value Investors

Benjamin Graham

Known as the “father of value investing,” Benjamin Graham developed this strategy in the 1920s, advocating for thorough analysis and “intelligent investing.” He mentored Warren Buffet, influencing Buffet’s own strategies.

Warren Buffet

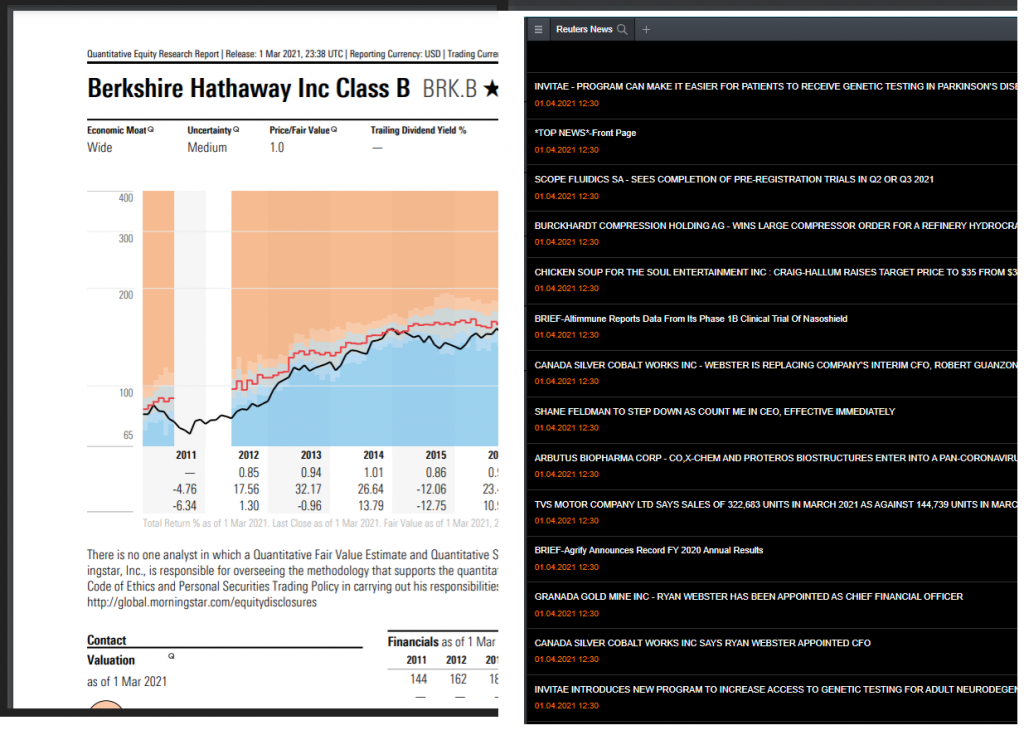

Warren Buffet, among the most famous investors, operates Berkshire Hathaway, which holds shares in stable companies like American Express, Coca-Cola, and Verizon. Berkshire Hathaway’s average annual return of over 20% highlights the power of value investing.

Trading vs. Value Investing

The primary distinction between trading and value investing is timeframe. Value investing involves paying the full share value and holding long-term. In contrast, trading allows speculation on price movements with only a fraction of the share value as a deposit.

Some stocks, like Berkshire Hathaway, can be expensive, making direct purchase challenging. As an alternative, investors can use derivatives such as spread bets or CFDs, allowing market exposure without asset ownership. This approach enables long or short positions based on anticipated price direction but carries inherent risks.

Long-term Stock Trading

Long-term stock trading provides an alternative to value investing and helps diversify a portfolio by engaging in multiple markets. Here’s how to begin:

- Register for an account.

- Choose between spread betting and CFDs. Spread betting offers tax advantages in the UK.

- Select your stock. Assess its long-term value using fundamental analysis, and our market sentiment tool can provide insights on trader positions.

- Adopt a long-term strategy like position trading, which allows both long and short trades. Compare the differences between trading and investing, such as tax and duration.

- Stay informed on stock market news. Once registered, you’ll access Morningstar reports and Reuters news releases, along with daily updates from our analysts.

Our Next Generation trading platform offers over 8,000 stocks and 1,000 ETFs. Mutual funds and ETFs focusing on value stocks can further diversify your portfolio. Browse popular value ETFs from providers like iShares, Invesco, and Vanguard in our Product Library.